BDO Unibank and its community banking arm BDO Network Bank continue to empower the provinces of Leyte, Samar, and Biliran by providing relevant financial solutions to address their residents’ and businesses’ unique banking needs.

In this ever-changing economic landscape, accessibility to innovative and relevant financial products and services is pivotal in empowering individuals and businesses to thrive. BDO Network Bank understands this and has been steadfast in their mission to deliver banking solutions appropriate to the diverse requirements of the communities in the critical provinces of Eastern Visayas.

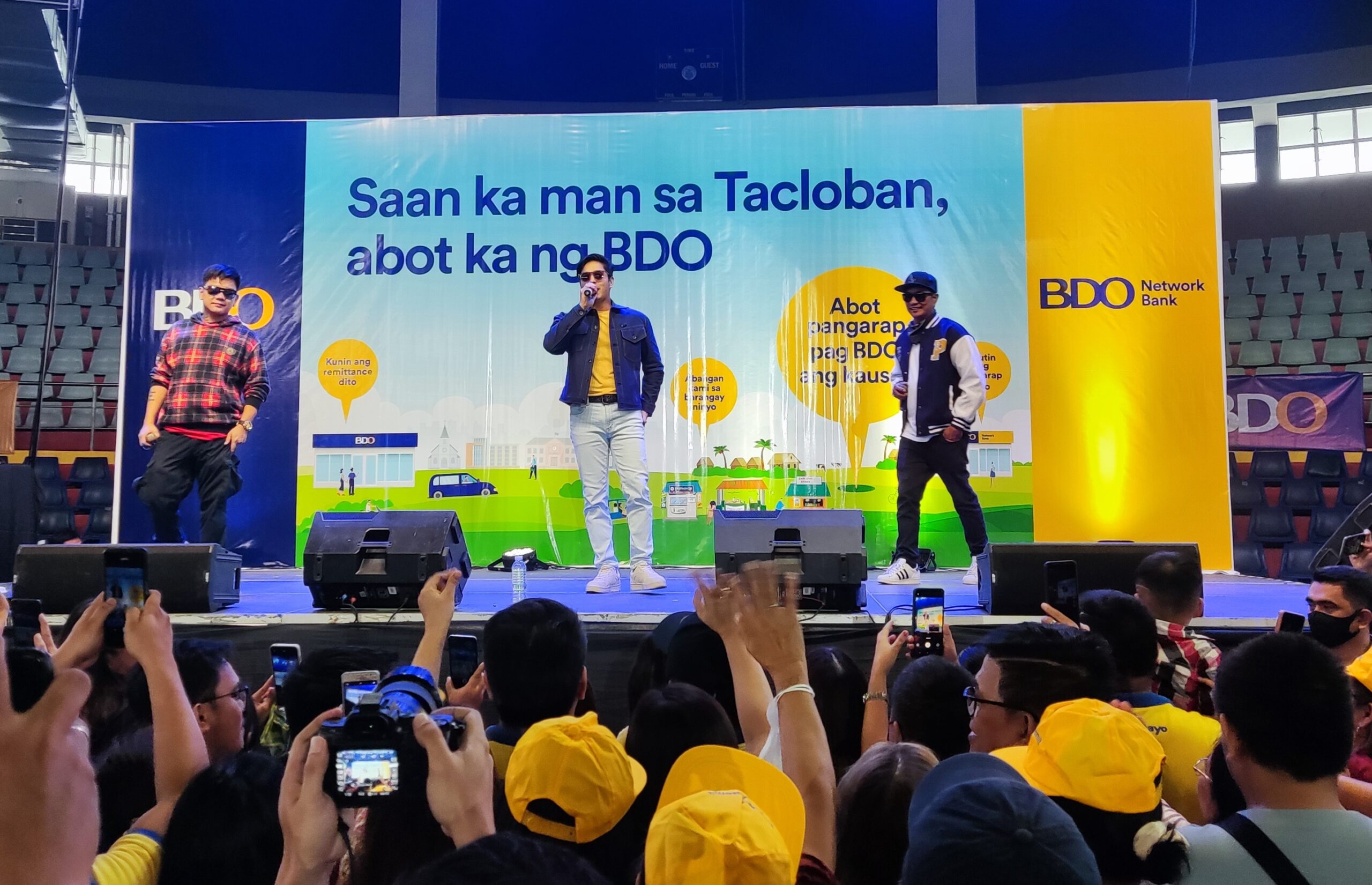

The banks jointly held month-long on-the-ground activities in Alang-alang, Burauen, and Kananga municipalities in Leyte; municipality of Gandara in Samar; and Naval in Biliran. They ended with a Thanksgiving Day program and financial education sessions for small business owners, overseas Filipinos (OFs) and their beneficiaries. Fun games and entertainment highlighted the event, with BDO Network Bank brand ambassador Coco Martin as a special guest.

Financial solutions for everyone

BDO and BDO Network Bank can offer a comprehensive range of personal banking services with their combined branches in key cities and the countryside. Individuals can benefit from personalized banking solutions — savings accounts, loans, microinsurance, remittance, and investment opportunities – helping them achieve their financial goals and secure their future.

The banks also extend various financial solutions to business owners, such as Negosyante Loan for expansion, online banking, and cash management solutions. These offerings help facilitate smooth operations, enhance productivity, and expand market reach.

“BDO and BDO Network Bank share a common purpose — enabling individuals, businesses, and communities to reach their full potential. Together, we are committed to being a steadfast partner in our customers’ journey towards progress and inclusive growth,” said BDO Network Bank president Jesus Antonio S. Itchon.

For OFs and beneficiaries, Kabayan Savings is a starting point for them to build their financial foundation. It provides a platform for saving and accumulating funds for various purposes such as investments, education, starting a business, or preparing for retirement.

Meanwhile, for communities in remote areas without traditional bank branches, BDO Cash Agad provides convenient access to funds for daily expenses, emergencies, or business needs. Using partner agents such as sari-sari stores, gasoline stations, water refilling stations, and mini-groceries, customers can make cash withdrawals, bills payment, and other basic banking transactions through a point-of-sale (POS) terminal, a physical device like what is often seen in groceries or shopping malls to facilitate payment.

BDO and BDO Network also support the growth of various micro, small, and medium enterprises (MSMEs) in Leyte, Samar, and Biliran, primarily in the agriculture, manufacturing, wholesale, and retail trade and services sectors. BDO Network Bank, for instance, offers Negosyante Loan especially designed for MSMEs needing additional funding for business operations or expansion purposes. With flexible payment terms, business owners can borrow from P30,000 to P500,000.

As an added support, BDO Network Bank held “Negosyante Day”, a financial literacy session for micro-business owners aimed at helping them grow and sustain their business through practical insights.

BDO and BDO Network Bank have a combined 28 branches in the three provinces and Cash Agad partner agents totaling 843. Five BDO Network Bank loan offices are also ready to serve clients’ needs.